TSLA Breakout Setup: Why We’re Targeting $400

Tesla has reclaimed both the swing high AVWAP and the 50 EMA, signaling bullish trend control. With Semi production and robotaxis ahead, we’re targeting $400.

📅 Tesla Sets Stage for Long-Term Breakout

Tesla (TSLA) is showing signs of renewed strength as it consolidates just below key resistance. With several product catalysts ahead and macro trends favoring U.S.-based innovation and EV leadership as well as with easing tariffs from the new U.S. Administration , we believe the stock is gearing up for a breakout — with the stock reaching our price target of $400.

📈 Technical Setup & Price Structure

Tesla is back above the swing high anchored VWAP, which had acted as resistance throughout the recent pullback since the all time highs of $480. Reclaiming this level signals that buyers are back in control of the average price from the prior high.

Additionally, TSLA has just recaptured the 50-day EMA, another sign of bullish trend momentum returning.

- Key breakout level: $350

- First target zone: $484.75 (All Time Highs)

- Major target: $400 — based on multi-quarter resistance breakout and product cycle ramp

- Support: $270–$310 (AVWAP zone + rising demand zone)

With TSLA holding higher lows, reclaiming the 50 EMA, and flipping AVWAP resistance into support, the trend now favors the bulls. A daily close above $350 could trigger a powerful continuation.

TESLA DAILY CHART:

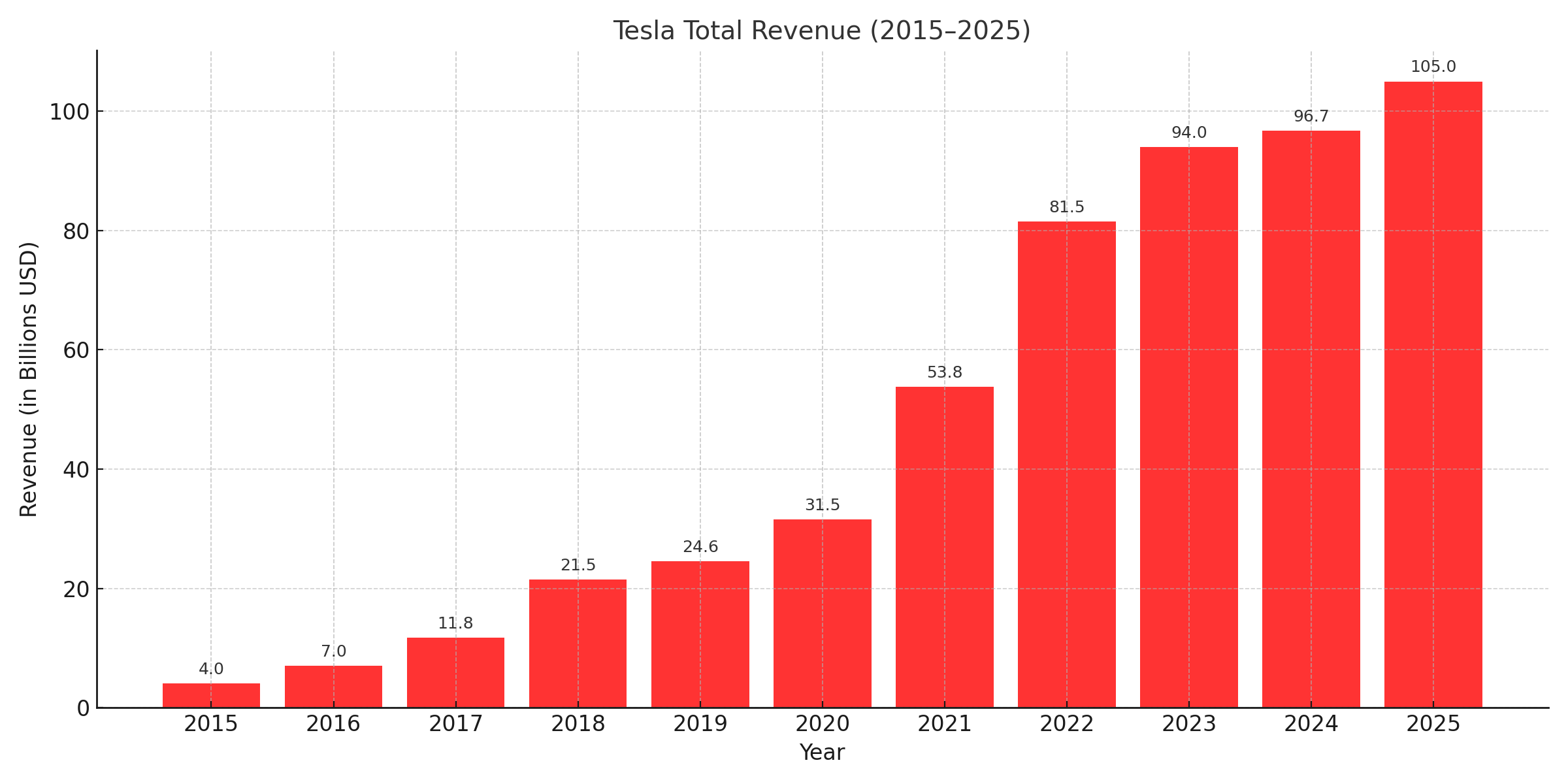

💼 Key Financial Highlights (Q4 2024)

Tesla remains one of the few profitable global EV manufacturers, with strong capital reserves and industry-leading margins despite pricing pressure.

📰 Recent News & Macro Tailwinds

Tesla Semi Production Begins in 2025: Tesla confirmed it will begin production of its Semi truck by late 2025 at its Nevada Gigafactory, scaling to 50,000 units annually.

Robotaxi Vision Advancing: Elon Musk reiterated Tesla’s plans to roll out a robotaxi network — a high-margin recurring revenue business with enormous scale potential.

National Manufacturing Edge: With U.S. tariffs intensifying, Tesla’s domestic vertical integration gives it a distinct advantage over foreign EV competition.

Energy & Infrastructure Play: Tesla’s role in battery storage, solar, and AI compute (Dojo) makes it more than just a carmaker — it’s becoming a national infrastructure layer.

🇺🇸 Personal Thesis

I’m long Tesla because:

- It’s breaking back above critical technical zones like swing high AVWAP and the 50 EMA

- Its fundamentals remain strong, and is now possibly benefited by the easing in tariffs.

- The company has unmatched scale and vertical integration

- The upcoming product cycle — including Semi trucks and robotaxis — could drive renewed revenue acceleration

- Tesla aligns with macroeconomic trends in U.S. reshoring, energy independence, and AI mobility

“This is the perfect storm of price action, positioning, and product roadmap. I’m long TSLA with conviction — and I’m looking for $400.”

📝 Final Thoughts

Tesla’s current structure shows the potential for a powerful breakout. Combined with:

- A clean technical reclaim of AVWAP and the 50 EMA

- A growing suite of products and verticals

- A macro environment that rewards U.S.-centric innovation

We believe Tesla has the foundation for a major move toward $400 over the next few quarters.